Supermarkets

& Grocery Stores

Small Business Owner Resource

SBA 7(a) lending intel on SBAmatch is designed to help Small Business Owners avoid the mistake of applying with the wrong lender. Every lender is different, and matching to the right one with the highest probability of approving an SBA loan will save countless headaches.

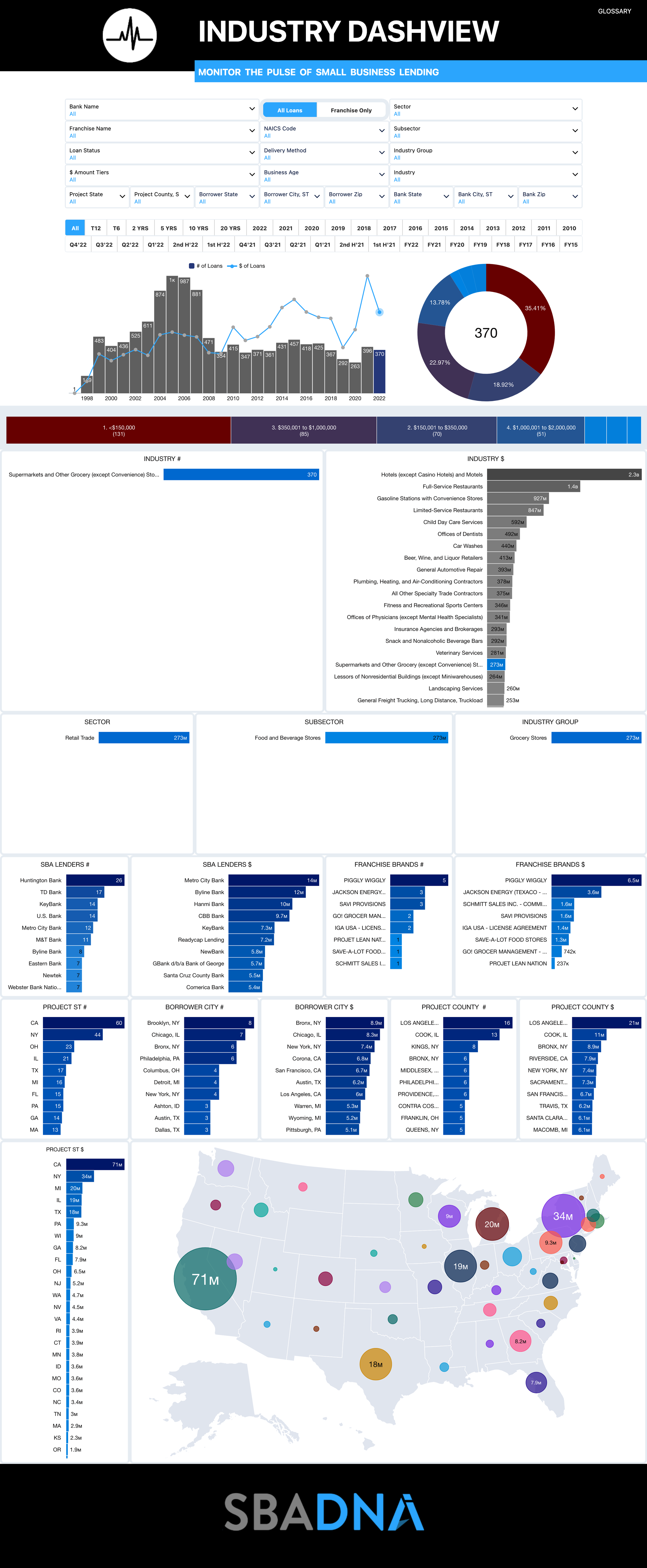

Below is the most recent lending data for the Supermarkets & Grocery Stores industry.

2021 Loans:

Lenders: 157

Approvals: 396

Amounts: $395M

Average: $998,155

2022 Loans:

Lenders: 148

Approvals: 370

Amounts: $273M

Average: $737,422

All-Time Loans:

Lenders: 1,164

Approvals: 12,090

Amounts: $5B

Average: $412,407

Supermarkets & Grocery Stores Industry Lending Data For All SBA 7(a) Loans:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

Supermarkets & Grocery Stores Industry Lending Data For Franchise SBA 7(a) Loans Only:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

60%

of all SBA Lenders of all time have never approved an SBA loan over $1 Million.

We can find the right one for you; for free. LEARN MORE.

Byline Bank Is A Top-Ranked Lender For Supermarkets & Grocery Stores

Ad*

Resources:

NAICS INDUSTRY

Our SBA 7a lending information is based on Supermarkets and Other Grocery Stores NACIS code 445110.

The NAICS website describes this industry as:

This industry comprises establishments generally known as supermarkets and grocery stores primarily engaged in retailing a general line of food, such as canned and frozen foods; fresh fruits and vegetables; and fresh and prepared meats, fish, and poultry. Included in this industry are delicatessen-type establishments primarily engaged in retailing a general line of food.