Full-Service

Restaurants

Small Business Owner Resource

SBA 7(a) lending intel on SBAmatch is designed to help Small Business Owners avoid the mistake of applying with the wrong lender. Every lender is different, and matching to the right one with the highest probability of approving an SBA loan will save countless headaches.

Below is the most recent lending data for the Full-Service Restaurant industry.

2021 Loans:

Lenders: 561

Approvals: 2,054

Amounts: $1.3B

Average: $649,232

2022 Loans:

Lenders: 557

Approvals: 2,484

Amounts: $1.4B

Average: $561,698

All-Time Loans:

Lenders: 2,804

Approvals: 72,054

Amounts: $22.5B

Average: $311,974

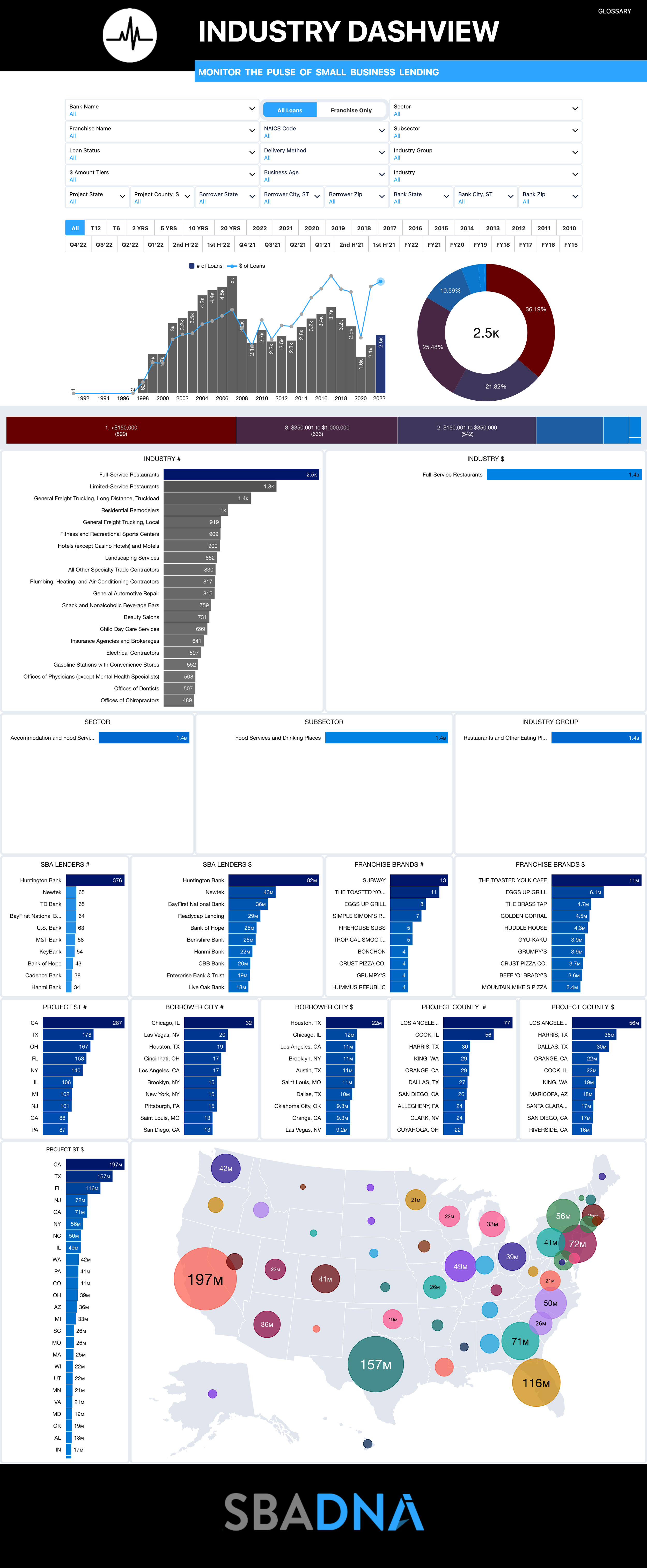

Full-Service Restaurant Industry Lending Data For All SBA 7(a) Loans:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

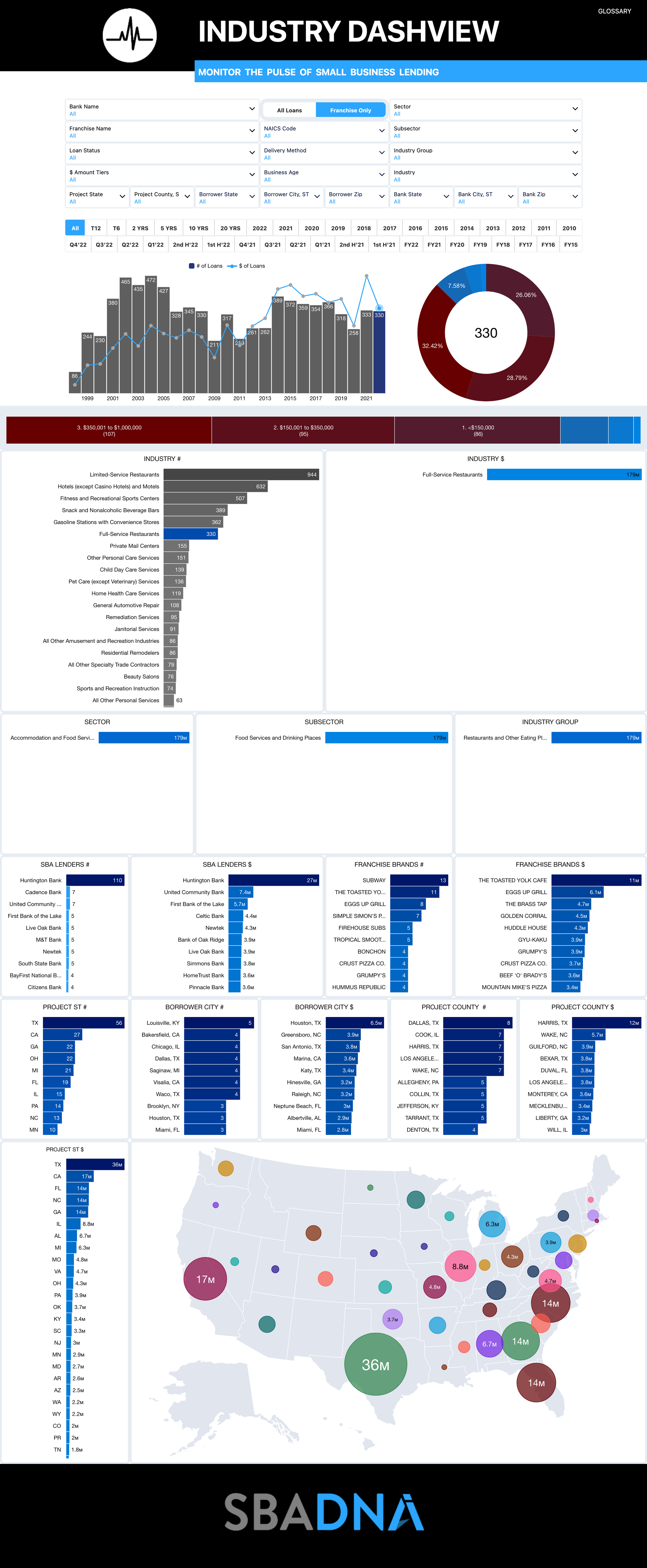

Full-Service Restaurant Industry Lending Data For Franchise SBA 7(a) Loans Only:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

60%

of all SBA Lenders of all time have never approved an SBA loan over $1 Million.

We can find the right one for you; for free. LEARN MORE.

Byline Bank Is A Top-Ranked Lender For Full-Service Restaurants

Ad*

Resources:

NAICS INDUSTRY

Our SBA 7a lending information is based on Full-Service Restaurants NACIS codes 722110 (old) and 722511.

The NAICS website describes this industry as:

This U.S. industry comprises establishments primarily engaged in providing food services to patrons who order and are served while seated (i.e., waiter/waitress service) and pay after eating. These establishments may provide this type of food service to patrons in combination with selling alcoholic beverages, providing carryout services, or presenting live nontheatrical entertainment.