Dentists

Small Business Owner Resource

SBA 7(a) lending intel on SBAmatch is designed to help Small Business Owners avoid the mistake of applying with the wrong lender. Every lender is different, and matching to the right one with the highest probability of approving an SBA loan will save countless headaches.

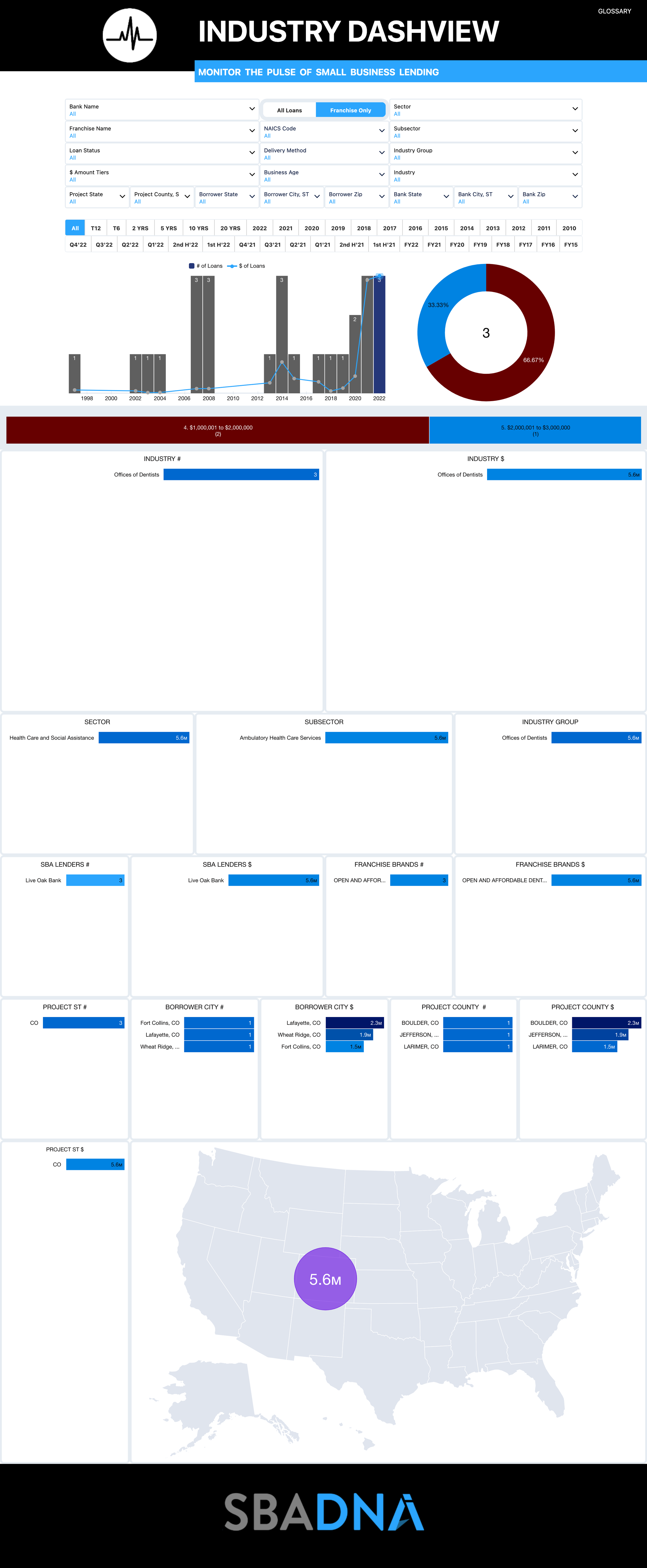

Below is the most recent lending data for the Dentist industry.

2021 Loans:

Lenders: 193

Approvals: 859

Amounts: $924M

Average: $1,075,305

2022 Loans:

Lenders: 125

Approvals: 507

Amounts: $492M

Average: $970,284

All-Time Loans:

Lenders: 1,428

Approvals: 28,810

Amounts: $12.6B

Average: $435,429

Dentist Industry Lending Data For All SBA 7(a) Loans:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

Dentist Industry Lending Data For Franchise SBA 7(a) Loans Only:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

60%

of all SBA Lenders of all time have never approved an SBA loan over $1 Million.

We can find the right one for you; for free. LEARN MORE.

Byline Bank Is A Top-Ranked Lender For Restaurants And Eating Places

Ad*

Resources:

NAICS INDUSTRY

Our SBA 7a lending information is based on Offices of Dentists NACIS code 621210.

The NAICS website describes this industry as:

This industry comprises establishments of health practitioners having the degree of D.M.D. (Doctor of Dental Medicine), D.D.S. (Doctor of Dental Surgery), or D.D.Sc. (Doctor of Dental Science) primarily engaged in the independent practice of general or specialized dentistry or dental surgery. These practitioners operate private or group practices in their own offices (e.g., centers, clinics) or in the facilities of others, such as hospitals or HMO medical centers. They can provide either comprehensive preventive, cosmetic, or emergency care, or specialize in a single field of dentistry.