Historical and Current SBA 7(a) Lending Data for Citizens Bank

Small Business Owner Resource

SBA 7(a) lending intel on SBAmatch is designed to help Small Business Owners make the smartest decisions possible when selecting a lender to apply with. Every lender is different, and matching to the right one with the highest probability of approving your type of SBA loan will save countless headaches.

Below is the most recent SBA lending data for Citizens Bank.

2021 Loans:

Industries: 98

Approvals: 330

Amounts: $242M

Average: $733,896

2022 Loans:

Industries: 86

Approvals: 242

Amounts: $159M

Average: $655,675

All-Time Loans:

Industries: 315

Approvals: 2,237

Amounts: $1.4B

Average: $628,006

Contact Citizens Bank directly: 800-862-6200

Let us handle your loan for you. For free: 970-236-4788

Citizens Bank Lending Data For All SBA 7(a) Loans:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

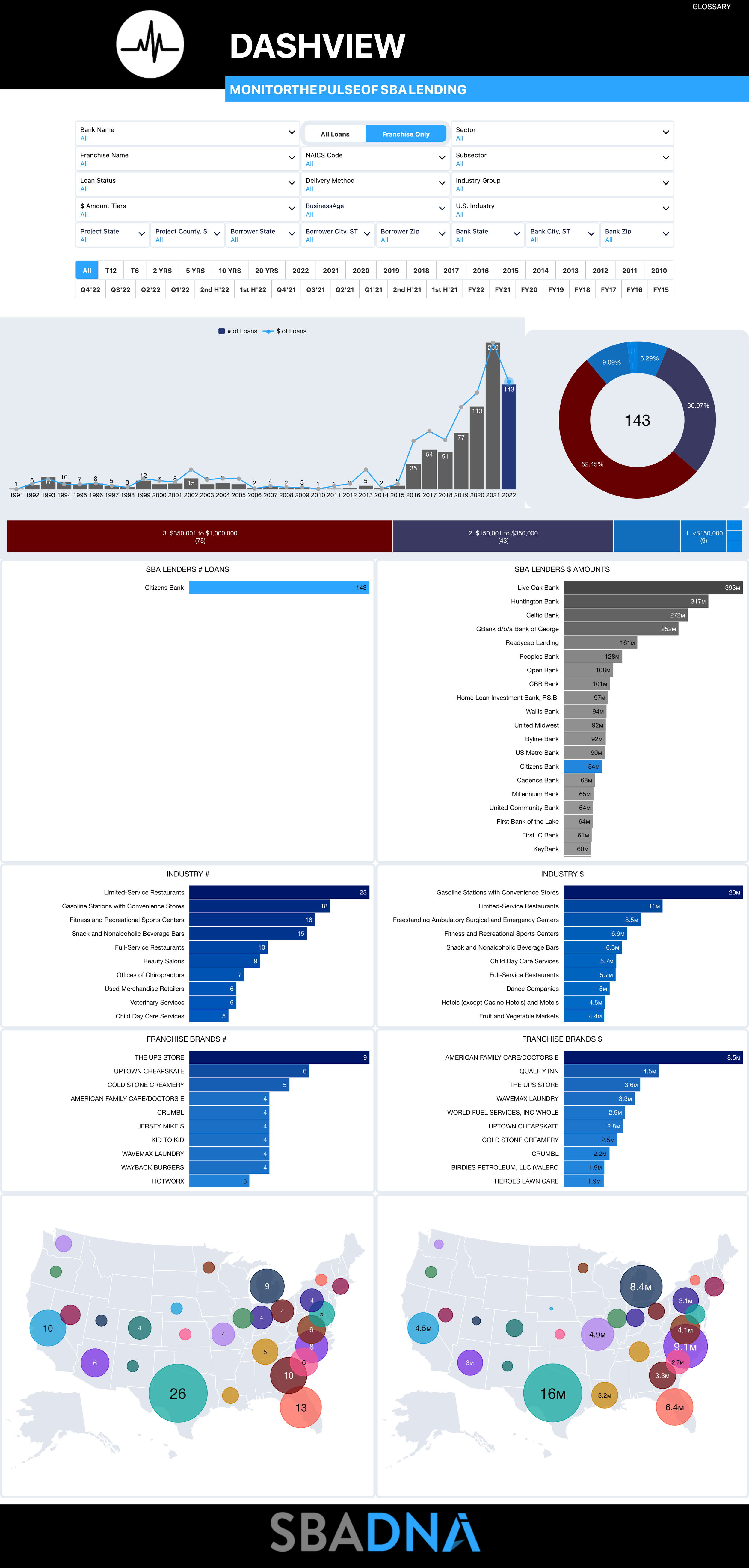

Citizens Bank Lending Data For Franchise SBA 7(a) Loans Only:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

This intel is provided by SBADNA, an SBAmatch sister company.

Our SBA Lending Experts can leverage this intel with long-standing banking relationships to help you find the right loan for FREE.