Historical & Current SBA 7(a) Lending Intel for Super 8

Small Business Owner Resource

SBA 7(a) lending intel on SBAmatch is designed to help Franchisors and Franchisees make smarter lending decisions. Every franchise, industry, geography, and lender is different, and selecting the right combination will avoid headaches and produce the highest probability of getting an SBA loan approved.

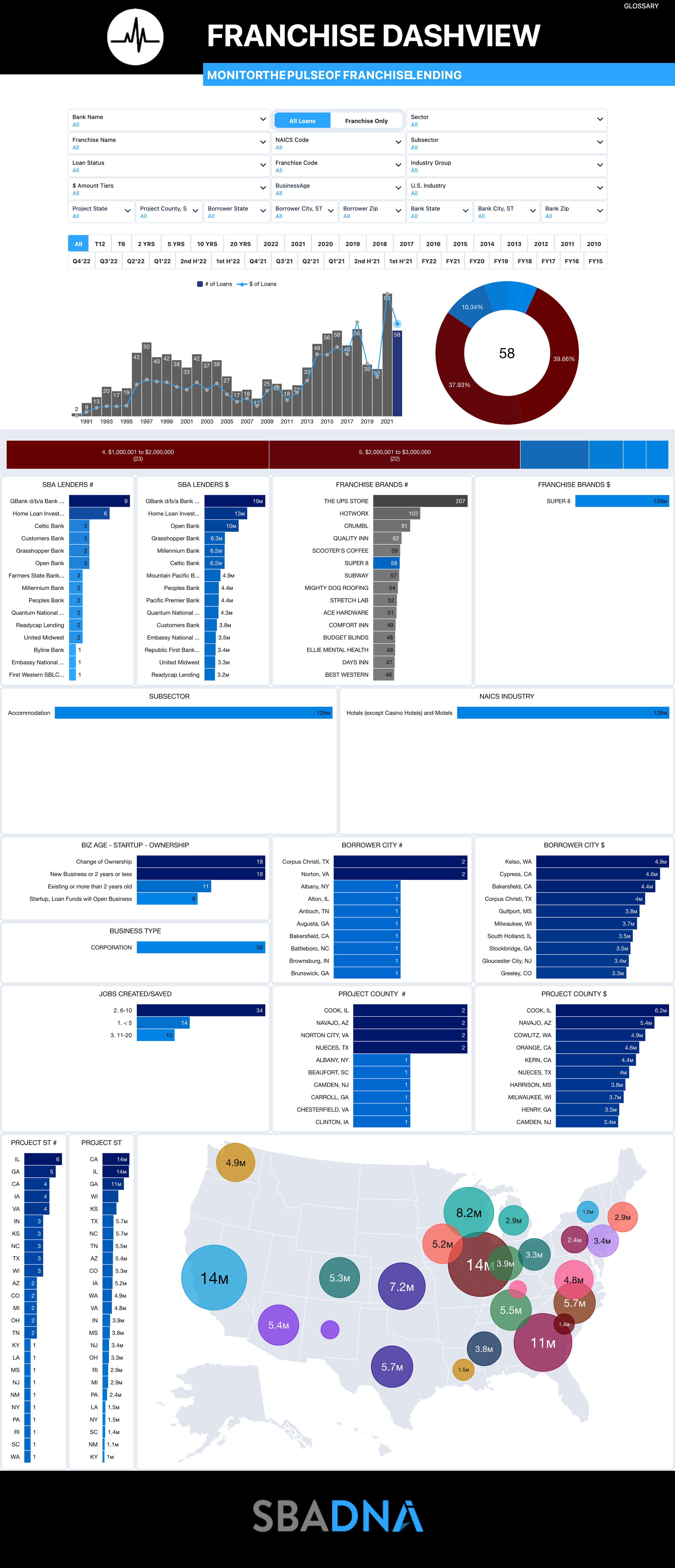

Below is the most recent lending data for the Super 8 franchise brand.

2021 Loans:

Lenders: 39

Approvals: 83

Amounts: $167M

Average: $2,009,663

2022 Loans:

Lenders: 31

Approvals: 58

Amounts: $126M

Average: $2,167,588

All-Time Loans:

Lenders: 256

Approvals: 1,114

Amounts: $1.6B

Average: $1,445,442

Super 8 Franchise Brand Lending Data For SBA 7(a) Loans:

Data updated through 12/31/2022. See SBADNA Data Source & Methodology for more details.

This intel is provided by SBADNA, an SBAmatch sister company.

Our SBA Lending Experts can leverage this intel with long-standing banking relationships to help you find the right loan for FREE.